Investor Relations

Corporate Governance

(Updated on 10 April 2025)

The board considers that good corporate governance of the Company is central to safeguarding the interests of the shareholders and enhancing the performance of the Group. The board is committed to maintaining and ensuring high standards of corporate governance. The Company has applied the principles and complied with all the applicable code provisions (“Code Provisions”) of Part 2 of the Corporate Governance Code (“Code”) as set out in Appendix C1 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (“Listing Rules”) for the year ended 31 December 2024, except the followings:

Code Provision C.2.1 provides that the roles of the chairman and the chief executive should be separate and should not be performed by the same individual. The Company does not have a designated chief executive. The board oversees the management, businesses, strategy and financial performance of the Group. The day-to-day business of the Group is handled by the executive directors collectively. The executive directors supported by the senior executives are delegated with the responsibilities of running the business operations and making operational and business decisions of the Group. The board considers that this structure is adequate to ensure an effective management and control of the Group’s businesses and operations. The structure outlined above will be reviewed regularly to ensure that sound corporate governance is in place.

The board will continuously review and improve the corporate governance practices and standards of the Company to ensure that business activities and decision making processes are regulated in a proper and prudent manner.

Our purpose, values and strategies represent the essence of our corporate culture and business framework. Our mission is to deliver high quality, safe and innovative toys to the consumers. We are diligent in our research and preparation so that we can “do it right the first time ”. We work hard to nurture and maintain a strong relationship with every partner by delivering on our promises. We are guided by our core values that our multi-disciplinary business in toys and other investments are built upon a common foundation of integrity, honesty, fairness and respect. All directors act with integrity, lead by example, and promote our corporate culture across the Company. They also play an important role in fostering and overseeing the Company’s culture to ensure that values of acting lawfully, ethically and responsibly are reflected in our strategy, business model, operating practices as well as our approach to risk. We have adopted and implemented a number of corporate policies, including but not limited to, Code of Business Conduct, Staff Handbook, Anti-corruption Policy and Whistleblowing Policy to ensure that our values are conveyed to all employees of the Company. All employees are required to comply with such policies. We review these policies from time to time to ensure that they are in line with our business, development strategies and stakeholders’ expectation.

Our goal is to continue our legacy established over 55 years ago through the creation of imaginative products and the long-term management of profitable brand franchises. We review our business plan and sustainability strategies from time to time for long-term development. We strive to generate and preserve our long-term value and deliver our objectives through the following strategies and commitments:

(i) preserve and enhance the values of the Group’s investments;

(ii) preserve and enhance the Group’s reputation;

(iii) deliver high quality products in a timely manner to the market;

(iv) control and optimize all cost elements; and

(v) meet the Company’s financial targets.

Please refer to the Statement from the Chairman and the Management Discussion and Analysis of this annual report for more details in relation to the Group’s performance.

Composition and Responsibilities

The board of directors of the Company comprises:

Executive Directors

CHAN Kwong Fai, Michael (Chairman)

CHAN, Helen

CHAN Kong Keung, Stephen

TRAN Vi-hang William

Independent Non-executive Directors

IP Shu Wing, Charles

LAM Wai Hon, Ambrose

YU Hon To, David

The board comprises four executive directors (one of whom is the Chairman) and three non-executive directors. All the non-executive directors are independent. Two independent non-executive directors possess appropriate professional accounting qualifications and financial management expertise. Save for the sibling relationship between Mr. Chan Kwong Fai, Michael, Ms. Chan, Helen and Mr. Chan Kong Keung, Stephen, the board members have no financial, business, family or other material or relevant relationships with each other.

The board is responsible for the oversight of overall strategic development, performance, risk management and governance of the Group and making decisions in relation thereto. The board also monitors the financial performance and the internal controls of the Group’s business operations. With a wide range of expertise and a balance of skills, the non-executive directors bring independent judgment on issues of strategic direction, development, performance and risk management through their contribution at board meetings and committee work. The executive directors supported by the senior executives are delegated with the responsibilities of running the day-to day business operations and making operational and business decisions of the Group.

The independent non-executive directors also serve the important function of ensuring and monitoring the basis for an effective corporate governance framework. The board considers that each independent non-executive director is independent in character and judgment and that they all meet the specific independence criteria as required by the Listing Rules. Each of the independent non-executive director has confirmed his independence under Rule 3.13 of the Listing Rules and the Company confirmed that it still considered such directors to be independent. The independent non-executive directors are explicitly identified in all corporate communications.

The Company recognizes that board independence is vital to good corporate governance and board effectiveness. There are mechanisms in place to ensure independent views and input are available to the board for enhancing objective and effective decision making:

(a) Three out of the seven directors are independent non-executive directors which exceeds the Listing Rules requirement for independent non-executive directors to make up at least one third of the board. Apart from complying with the requirements prescribed by the Listing Rules as to the composition of certain board committees, independent non-executive directors are appointed to the board committees as far as practicable to ensure independent views are available.

(b) The Nomination Committee strictly adheres to the Nomination Policy and the independence assessment criteria as set out in the Listing Rules with regard to the nomination and appointment of independent non-executive directors.

(c) The Nomination Committee assesses the continued independence of the independent non-executive directors on an annual basis. All the independent non-executive directors will confirm their compliance of independence requirements as set out under Rule 3.13 of the Listing Rules.

(d) No equity-based remuneration (e.g. share options or grants) with performance related elements is granted to independent non-executive directors. Any grant of share options or awards to a director under the share option or share award scheme must be approved by the independent non-executive directors.

(e) Separate discussions amongst the independent non-executive directors and the chairman of the board without the presence of executive directors and the senior management.

(f) Independent non-executive directors (as other directors) are entitled to seek further information and documentation from the management on the matters to be discussed at board meetings. They can also seek assistance and independent advice from external professional advisers at the Company’s expense where necessary.

(g) Directors shall not vote or be counted in the quorum on any board resolution approving any contract or arrangement in which such director or any of his/her close associates has a material interest.

During the year, the Board has reviewed and considered that the abovesaid mechanisms are effective in ensuring that independent views are available to the board.

Each of the directors (including non-executive directors) of the Company has entered into a service contract with the Company for a term of three years. However, such term is subject to his re-appointment by the Company at general meeting upon retirement by rotation pursuant to the Bye-laws of the Company. In accordance with the relevant provisions in the Bye-laws of the Company, the appointment of directors is considered by the board and newly appointed directors are required to stand for election by shareholders at the first annual general meeting following their appointment. Each director, including the chairman of the board and/or the managing director, shall be subject to retirement by rotation at least once every three years.

All directors are provided with monthly updates on the Group’s performance, position and prospects.

There is an established procedure for directors to obtain independent professional advice at the expense of the Company in the furtherance of their duties. The Company has also arranged appropriate director and officer liability insurance policy covering potential legal actions that might be taken against its directors.

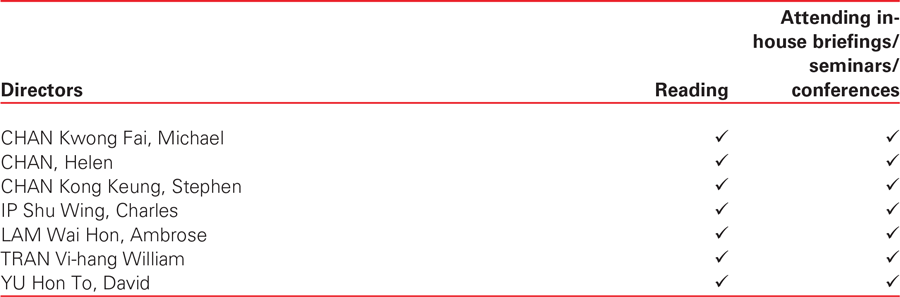

Pursuant to the Code, all directors should participate in continuous professional development to develop and refresh their knowledge and skills. During the year ended 31 December 2024, all directors have participated in continuous professional development programmes such as in-house briefings and external seminars to develop and refresh their knowledge and skills. Materials on new or salient changes to laws and regulations applicable to the Group were provided to the directors. All directors have provided the Company with their respective training record pursuant to the Code.

The participation of each director of the Company in continuous professional development in 2024 was as recorded in the table below:

Board Meetings and Proceedings

The board meets regularly throughout the year to review the overall strategy and to monitor the operation as well as the financial performance of the Group. Senior executives are from time to time invited to attend board meetings to make presentations or answer the board’s enquiries. The Chairman focuses on Group strategy and is responsible for ensuring all key issues are considered by the board in a timely manner. Notice of at least 14 days has been given to all directors for all regular board meetings and the directors can include matters for discussion in the agenda whenever they consider appropriate and necessary. Agenda and accompanying board papers in respect of regular board meetings are dispatched in full to all directors within a reasonable time before the meeting. Directors have to declare their direct or indirect interests, if any, in any proposals or transactions to be considered by the board at board meetings and abstain from voting as appropriate.

Draft minutes of all board meetings are circulated to directors for comment within a reasonable time prior to confirmation. Minutes of board meetings and meetings of board committees are kept by duly appointed secretaries of the respective meetings; all directors have access to board papers and related materials, and are provided with adequate information in a timely manner; this enables the board to make informed decision on matters placed before it.

The board held four meetings in 2024. Details of directors’ attendance at the board meetings, other committee meetings and the annual general meeting during the year are set out in the following table.

| Directors | Board | Audit Committee | Compensation Committee | Nomination Committee | AGM |

|---|---|---|---|---|---|

| CHAN Kwong Fai, Michael | 4/4 | N/A | 2/2 | 1/1 | 1/1 |

| CHAN, Helen | 4/4 | N/A | N/A | N/A | 1/1 |

| CHAN Kong Keung, Stephen | 4/4 | N/A | N/A | N/A | 1/1 |

| IP Shu Wing, Charles | 4/4 | 2/2 | 2/2 | 1/1 | 1/1 |

| LAM Wai Hon, Ambrose | 4/4 | 2/2 | 2/2 | 1/1 | 1/1 |

| TRAN Vi-hang William | 4/4 | N/A | N/A | N/A | 1/1 |

| YU Hon To, David | 4/4 | 2/2 | N/A | 1/1 | 1/1 |

As an integral part of good corporate governance, the board has established the Audit Committee, Compensation Committee and Nomination Committee to oversee particular aspects of the Company’s affairs. Each of these Committees comprises a majority of independent non-executive directors with defined written terms of reference.

The Audit Committee was established in July 2007 and its current members include:

YU Hon To, David (Independent Non-executive Director) – Committee Chairman

IP Shu Wing, Charles (Independent Non-executive Director)

LAM Wai Hon, Ambrose (Independent Non-executive Director)

All of the Audit Committee members are independent non-executive directors. The board considers that each Audit Committee member has broad commercial experience and there is a suitable mix of expertise in business, accounting and financial management on the Audit Committee. The composition and members of the Audit Committee exceeds the requirements under Rule 3.21 of the Listing Rules which requires at least one independent non-executive director with appropriate professional qualifications or accounting or related financial management expertise. The written terms of reference of the Audit Committee are posted on the websites of the Company and the Stock Exchange.

The Audit Committee meets at least twice a year to review the reporting of financial and other information to shareholders, the system of internal controls, risk management and the effectiveness and objectivity of the audit process. The Audit Committee also provides an important link between the board and the Company’s external auditors in matters coming within the scope of its written terms of reference and keeps under review the independence and objectivity of the external auditors.

The Audit Committee has held two meetings during the financial year. During the year, the Audit Committee reviewed the Company’s interim and annual results for the year ended 31 December 2024. It reviewed with the management the accounting principles and practices adopted by the Group and discussed the risk management and internal control system, the effectiveness of the internal audit function and financial reporting matters. It also reviewed the independence and the appointment of the external auditors and its remuneration.

At the meeting held on 14 March 2025, the Audit Committee reviewed this report, the Directors’ Report and accounts for the year ended 31 December 2024 together with the annual results announcement, with a recommendation to the board of directors for approval.

The Compensation Committee was established in July 2007 and its current members include:

IP Shu Wing, Charles (Independent Non-executive Director) – Committee Chairman

LAM Wai Hon, Ambrose (Independent Non-executive Director)

CHAN Kwong Fai, Michael (Chairman)

The majority of the Compensation Committee members are independent non-executive directors. The Compensation Committee advises the board on the Group’s overall policy and structure for the remuneration of directors and senior management. The written terms of reference of the Compensation Committee are posted on the websites of the Company and the Stock Exchange.

The Compensation Committee held two meetings during the year. The Compensation Committee met to determine the policy for the remuneration of directors and the Group and assess the performance of executive directors and members of senior management. During the year, it also reviewed and considered matters relating to the Group’s share schemes under Chapter 17 of the Listing Rules.

The Share Awards granted pursuant to the Share Award Plan during the year to certain employees (including an executive Director) and consultants of the Group (“Grantees”) had been reviewed and approved by the Compensation Committee where consideration has been given to the number of Share Awards, the vesting schedule and other terms to be imposed such as performance targets and the clawback/lapse mechanism where applicable. The Compensation Committee is of the view that the terms and conditions of such grants are consistent with the Group’s remuneration policy, and are appropriate and align with the purpose of the Share Award Plan, in order to recognise the contributions made by the Grantees and to attract and retain their talents for the continuous operations and development of the Group.

Director Remuneration Policy

The board believes that fair remuneration is critical to attract and retain the services of high calibre and experienced directors. Pursuant to the Director Remuneration Policy of the Company, the Compensation Committee is delegated with the authority and duties to establish, review, advise and make recommendations to the board regarding the Group’s remuneration policy and practices according to its written terms of reference. The Compensation Committee shall ensure that all the directors are appropriately remunerated in accordance with the Group’s business strategy and financial performance. In considering directors’ remuneration, certain factors are taken into consideration, where applicable, including but not limited to:

i. remuneration paid by comparable companies

ii. time commitment and responsibilities

iii. business objectives and strategies

iv. general business and economic conditions

v. the Group’s financial position and performance

vi. individual performance and/or contribution to the Group

vii. retention consideration and individual potential

Pursuant to the written terms of reference of the Compensation Committee, it makes recommendations to the board from time to time on the remuneration of the non-executive directors (including independent non-executive directors). The compensation of non-executive directors, including the Compensation Committee members, shall be reviewed by executive directors initially, and the executive directors shall communicate their findings to the Compensation Committee. The Compensation Committee will then consider and make recommendations to the full board for final approval. Subject to relevant laws and regulatory requirements, equity-based remuneration (e.g. share options or grants) with performance-related elements will not be granted to independent non-executive directors. The Compensation Committee is also responsible for determining the remuneration for executive directors and the Chairman of the board. The Compensation Committee ensures that no director or any of his associate is involved in deciding his own remuneration.

Details of the directors’ fee and other emoluments of the directors of the Company are set out in note 13.1 to the financial statements and details of their entitlements to the share options of the Company are set out in the section of “Share Options” of the Report of the Directors.

The Nomination Committee was established in February 2012 and its current members include:

CHAN Kwong Fai, Michael (Chairman) – Committee Chairman

IP Shu Wing, Charles (Independent Non-executive Director)

LAM Wai Hon, Ambrose (Independent Non-executive Director)

YU Hon To, David (Independent Non-executive Director)

The majority of the Nomination Committee members are independent non-executive directors. The principal responsibility of the Nomination Committee is to review the size, structure and composition of the board, identify individuals suitably qualified to become board members, and assess the independence of independent non-executive directors. The written terms of reference of the Nomination Committee are posted on the websites of the Company and the Stock Exchange.

The Nomination Committee held one meeting during the year. The Nomination Committee reviewed the structure, size and diversity of the Board and assessed the independence of all independent non-executive directors and made recommendation to the board on the appointment and re-appointment of directors. All nomination were considered in accordance with the Nomination Policy and the objective criteria therein (including but not limited to skills, knowledge, experience, expertise, professional and educational qualifications), with due regard to the benefits of diversity as set out in the Board Diversity Policy.

Board Diversity

The board has adopted a Board Diversity Policy since August 2013. Such policy aims at achieving board diversity through the consideration of a number of aspects, including but not limited to gender, age, cultural and educational background, ethnicity, professional experience, skills, knowledge and length of service. All board appointments will be based on meritocracy, and candidates will be considered against objective criteria, having due regard to the benefits of diversity on the board. During the year, the board has reviewed the implementation of the Board Diversity Policy to ensure continued effectiveness and compliance with regulatory requirements and good corporate governance practices.

The board recognizes the importance and benefits of gender diversity at the board level. Out of seven directors, our board currently has one female director, which represents 14.3% of the board. The board targets to maintain at least the current level of female representation in the next 5 years.

In the long run, we shall continue to take steps to further enhance gender diversity as and when suitable candidates are identified. We will also ensure that there continues to be gender diversity when recruiting staff at mid to senior level and provide training and long-term development opportunities to staff of all genders, so that we will have a pipeline of senior management and potential successors to our board of all genders in due course.

We also strive to maintain gender diversity when recruiting and selecting key management and other personnel across the Group’s operations. As at 31 December 2024, we maintained a 48:52 ratio of female to male in our workforce. It is our objective to continue to maintain an appropriate balance of gender diversity with reference to market practices and our business needs.

Nomination Policy

The board has adopted a Nomination Policy in December 2018. Such policy sets out the criteria and procedures of considering candidates to be appointed or re-appointed as directors of the Company. When the Board recognises the need to appoint a director, the Nomination Committee may identify or select candidates recommended to the Committee, with or without assistance from external agencies. The Nomination Committee may then use any process that it considers appropriate in connection with its evaluation of a candidate, including but not limited to personal interviews and background checks. The Nomination Committee will have regard to the following factors when considering a candidate including without limitation:

- skills, knowledge, experience, expertise, professional and educational qualifications, background and other personal qualities of the candidate;

- effect on the board’s composition and diversity;

- commitment of the candidate to devote sufficient time to effectively carry out his/her duties;

- potential or actual conflicts of interest that may arise;

- independence of the candidate.

The board is collectively responsible for performing the corporate governance duties as below:

(i) develop and review the Company’s policies and practices on corporate governance;

(ii) review and monitor the training and continuous professional development of directors and senior management;

(iii) review and monitor the Company’s policies and practices on compliance with legal and regulatory requirements;

(iv) develop, review and monitor the code of conduct applicable to employees and directors; and

(v) review the Company’s compliance with the Code and disclosure in the Corporate Governance Report.

During the year, the board has reviewed the corporate governance structure, policies and practices of the Company. We will continue to ensure the governance policies including but not limited to the Whistleblowing Policy, Anti-corruption Policy, Director Remuneration Policy, Shareholders Communication Policy are implemented effectively and will review them regularly to further enhance the corporate governance of the Company.

The Company has adopted the Model Code for Securities Transactions by Directors of Listed Issuers (“Model Code”) as set out in Appendix C3 of the Listing Rules for securities transactions by directors of the Company. All the members of the board have confirmed, following specific enquiry by the Company, that they have complied with the required standard as set out in the Model Code throughout the year ended 31 December 2024. The Model Code also applies to other specified senior management of the Group.

Details of directors’ interests in the securities of the Company are set out in pages 24 to 25 of this annual report.

The company secretary is an employee of the Company and has been appointed by the board. The appointment and removal of the Company Secretary is subject to board approval. The company secretary reports to the board Chairman. All members of the board have access to the advice and service of the Company Secretary. During the year, the company secretary complied with the annual professional training requirement under Rule 3.29 of the Listing Rules to keep abreast of latest regulatory changes and corporate governance practices and to refresh her skills and knowledge.

The board has overall responsibility for maintaining an adequate system of risk management and internal controls of the Group and reviewing its effectiveness. The board is committed to implementing an effective and sound risk management and internal control system to safeguard the interest of shareholders and the Company’s assets.

The internal control process is accomplished by the board, management and other designated personnel, and designed to provide reasonable assurance regarding the achievement of objectives.

Our approach adopted for assessing the internal controls systems is based on those set by the COSO (the Committee of Sponsoring Organisations of the Treadway Commission), a globally recognized framework which categorizes internal controls into five components as the basis of reviewing its effectiveness, namely Control Environment, Risk Assessment, Information and Communication, Control Activities and Monitoring. In assessing our internal control system based on the above principles, we have taken into consideration of the nature of business as well as the organization structure. The system is designed to manage rather than eliminate the risk of failure to achieve business objectives, and can only provide reasonable but not absolute assurance against material misstatement or loss. The system is designed further to safeguard the Group’s assets, maintain appropriate accounting records and financial reporting, maintain efficiency of operations and ensure compliance with applicable laws and regulations.

Risk Management

The board is responsible for overseeing overall risk management framework of the Group. Risk is inherent in the Group’s business and the markets in which it operates. The Group’s overall risk management process is overseen by the board and risk management is also integrated into ongoing business activities, including business planning, capital allocation decisions, internal control and day-to-day operations. The board together with senior management, business units, auditors and internal audit consultant are committed to identifying and mitigating key risks through an effective risk management framework.

The Group’s risk management framework includes different layers of roles and responsibilities. Business units regularly review their risk profiles, and carry out risk management and reporting activities from time to time. Senior management is responsible for assessing material risks at the Group level, tracking progress of mitigation plans and reporting to the board regularly. The internal audit function performed by the Consultant (as defined below) also provides assurance to the board whether the control environments are adequate. The board oversees material risks that require attention and supervises the risk management process as a whole.

Control Effectiveness

The board has conducted an annual review of the risk management and internal control system which covered the relevant financial, operational, compliance controls and risk management functions within the established framework. The board’s annual review has also considered the adequacy of resources, qualifications and experience of staff of the Group’s accounting and financial reporting function as well as those relating to ESG performance and reporting, and their training programmes and budget. The board considered that the risk management and internal control system for the year was effective and adequate. No significant areas of concerns that may affect the financial, operational, compliance controls and risk management functions of the Group have been identified. The directors are satisfied with the effectiveness of the Group’s risk management and internal controls and consider that key areas of the Group’s system of internal controls are reasonably implemented, which provide prevention of material misstatement or loss, safeguard the Group’s assets, maintain appropriate accounting records and financial reporting, efficiency of operations and ensure compliance with the Listing Rules and all other applicable laws and regulations.

There was no internal audit function within the Group during the year. The board has appointed an external independent professional (“Consultant”) to perform the internal audit function for the Group for the year. The Consultant has reviewed the effectiveness of the Group’s material internal controls so as to provide assurance that key business and operational risks are identified and managed. The Consultant has reported to the board with its findings and makes recommendations to improve the risk management and internal control of the Group. The directors have reviewed the need for an internal audit function and are of the view that in light of the size, nature and complexity of the business of the Group, it would be more effective to appoint external independent professionals to perform internal audit functions for the Group.

With respect to procedures and internal controls for handling and dissemination of inside information, the Company has procedures and policies in place for ensuring compliance with the inside information disclosure requirements under the regulatory regime. The Company has provided Guidelines on Securities Dealing Restrictions and Disclosure Requirements to all directors and relevant employees at the relevant time in respect of assessing, reporting and disseminating inside information, and abiding shares dealing restrictions. The Company has also included in its code of business conduct and staff handbook a strict prohibition on the unauthorized disclosure or use of confidential information.

Whistleblowing Policy and Anti-Corruption Policy

The board established a Whistleblowing Policy since 2012. The main objective of the policy is to provide employees and external parties a reporting channel and procedures to report any serious misconduct or malpractice involving the Company and its employees even on an anonymous basis. The Audit Committee has been delegated with the overall responsibility for monitoring and reviewing the implementation of the Whistleblowing Policy.

Our Anti-corruption Policy outlines the Company’s policy and requirements relating to the prevention and reporting of any suspected corruption and related malpractice. We have also provided anti-corruption information or training to directors and employees to enhance their awareness.

For the year ended 31 December 2024, the auditors of the Group only provided audit services to the Group and the remuneration paid by the Group to the auditors for the performance of audit services was HK$1,570,000. In order to maintain their independence, the auditors will not be employed for non-audit work unless prior approval is obtained from the Audit Committee.

The directors acknowledge their responsibility for preparing the accounts of the Company for the year ended 31 December 2024. The statement of the auditors of the Company about their reporting responsibilities on the accounts is set out in the auditor’s report on pages 66 to 71 of this annual report.

The board understands the importance of maintaining effective communication with the Company’s shareholders and investors. The Company has established a Shareholders Communication Policy which will be reviewed by the board on an annual basis to ensure its effectiveness. The Company communicates with its shareholders and/or investors mainly by the following channels:

(i) The Company regards the annual general meeting or special general meetings (if any) as an important event in which all directors will make an effort to attend. The general meetings provide opportunities for the shareholders to communicate directly with the board. Separate resolutions are proposed at the general meetings on each substantially separate issue, including the election of individual directors. In order to enhance minority shareholders’ rights, all resolutions put to votes by shareholders at general meetings were passed by poll. The poll results will be published on the websites of the Company and the Stock Exchange on the same date of the meetings.

(ii) The Company publishes corporate communications including announcements, annual reports, interim reports and/or circulars as required by the Listing Rules to ensure that the shareholders receive accurate, clear and timely information about the Company. All corporate communications are available on the websites of the Company and the Stock Exchange.

(iii) All press releases and presentation materials provided in conjunction with the Company’s annual general meeting and results announcement, if any, are made available on the website of the Company as soon as practicable after their release.

(iv) Designated senior management of the Company maintains regular dialogue with institutional investors and analysts from time to time.

The Board reviewed the Shareholders’ Communication Policy for the year ended 31 December 2024 and was satisfied with its implementation and effectiveness.

Shareholders should direct their questions about their shareholdings and share registrations to the Company’s Registrar. The contact details of the Company’s Share Registrar are available on the “Stock Information” section of the website of the Company.

Shareholders may make enquiries to the Company by contacting the Company’s Investor Relations. The contact details of the Company’s Investor Relations are available on the “Contact Us” section of the website of the Company.

Shareholders may also make specific enquiries to the board by writing to the company secretary at the principal office of the Company.

Procedures for shareholders to convene a special general meeting and putting forward proposals at general meetings

Pursuant to the Bye-laws of the Company, shareholders holding at the date of the deposit of the requisition not less than one-tenth (10%) of the paid-up capital of the Company carrying the right of voting at general meetings of the Company shall have the right to submit a written requisition to the board or the company secretary, to require a special general meeting to be called by the board for the transaction of any business specified in such requisition; and such meeting shall be held within two (2) months after the deposit of such requisition. If within twenty-one (21) days of such deposit the board fails to proceed to convene such meeting the requisitionists themselves may do so in accordance with the provisions of Section 74(3) of the Bermuda Companies Act 1981 (“Act”).

Pursuant to the Act, either any number of the shareholders holding not less than one-twentieth (5%) of the paid-up capital of the Company carrying the right of voting at general meetings of the Company (“Requisitionists”), or not less than one hundred of such shareholders, can request the Company in writing to (a) give to shareholders entitled to receive notice of the next general meeting notice of any resolution which may properly be moved and is intended to be moved at that meeting; and (b) circulate to shareholders entitled to have notice of any general meeting any statement of not more than one thousand words with respect to the matter referred to in any proposed resolution or the business to be dealt with at that meeting. The requisition signed by all the Requisitionists must be deposited at the registered office of the Company with a sum reasonably sufficient to meet the Company’s relevant expenses and not less than six weeks before the meeting in case of a requisition requiring notice of a resolution and not less than one week before the meeting in the case of any other requisition. Provided that if an annual general meeting is called for a date six weeks or less after the requisition has been deposited, the requisition though not deposited within the time required shall be deemed to have been properly deposited for the purposes thereof.

Shareholders may make enquiries to the board by writing to the company secretary at the principal office of the Company.

During the year, there is no substantial change in the Memorandum of Association and Bye-laws of the Company.